Stock Market Volatility Tied to Increased Cardiovascular and Suicide Risks

Massive Study Uncovers Health Impacts of Market Fluctuations

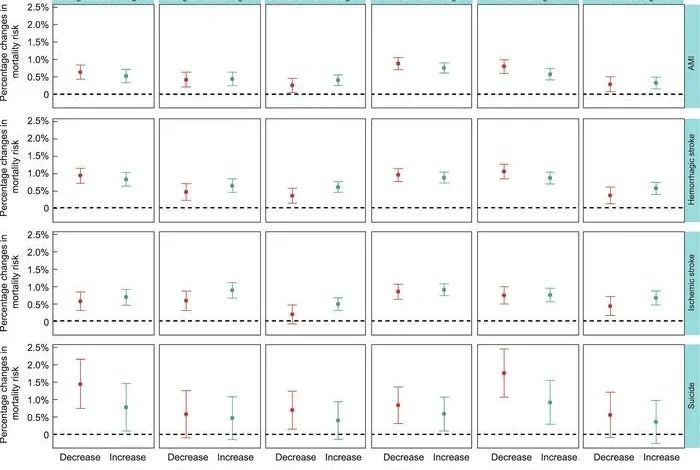

A thorough analysis of more than 12 million Chinese deaths has revealed a strong correlation between higher health risks and stock market volatility. The study, which was published in Engineering, shows a correlation between increased incidence of major adverse cardiovascular events (MACEs) and suicide with stock market increases and decreases.

A 1% drop in daily stock returns was shown to be associated with a 0.74%–1.04% increase in MACE-related mortality and a 1.77% increase in suicides, according to an analysis of data from 2013 to 2019. Surprisingly, market gains also had detrimental effects on health; a 1% rise in daily returns was associated with a 0.57%–0.85% increase in the chance of mortality.

These results demonstrate how financial market volatility affects public health in ways that go beyond simple economic considerations.

Demographic Variations in Risk

The study team determined which populations are more susceptible to the negative effects of stock market volatility on their health. The groups with the biggest increases in risk were men, those between the ages of 65 and 74, and those with less education.

One of the study’s authors, Dr. Haidong Kan, stated, “Our research demonstrates that the psychological stress induced by stock market volatility has severe and immediate health implications.” “This is a major public health concern that requires attention, not just a financial one.”

An individual-level time-stratified case-crossover design was used in the study, which made it possible to analyse mortality risks in a nuanced way by taking into account daily market volatility. Through the analysis of daily returns and intra-day fluctuations in three major Chinese stock indices, the researchers were able to clearly identify relationships between changes in the market and improvements in health.

Why this matters This study emphasises how closely financial markets and public health are related. It is crucial for people, healthcare institutions, and society at large to comprehend and reduce these health hazards as long as financial markets remain a major part of the global economy.

The findings prompt significant enquiries on the processes by which fluctuations in the market impact well-being. According to experts, physiological changes brought on by stress, like elevated blood pressure and inflammation, probably contribute to an increased risk of cardiovascular disease. The emotional toll of financial gains or losses may cause or worsen pre-existing psychological disorders, which can have an influence on mental health.

Correlation does not imply causality, according to critics, and these health outcomes could be influenced by other causes. But this study’s extensive scope and meticulous methodology offer compelling proof of a causal relationship between market volatility and health hazards.

The study’s conclusions point to the necessity of focused health education and psychological assistance, particularly in times of unstable markets. Campaigns by the government and the public could help reduce the risks of cardiovascular disease and mental illness brought on by stock market volatility.

The development and testing of interventions to reduce these health hazards, such as stress-reduction strategies, financial literacy initiatives, and focused health checks for high-risk populations during times of market volatility, may be future study paths.